property tax assistance program california

Homeowners Renter Assistance If you are blind disabled or at least 62 years old and meet State income restrictions the State may reimburse a portion of the property taxes paid on your. California residents who need help paying their property taxes can rely on DoNotPay.

California Mortgage Relief Program Camortgagehelp Twitter

Ad Lower your property taxes today - Guaranteed Savings No Up-Front Cost.

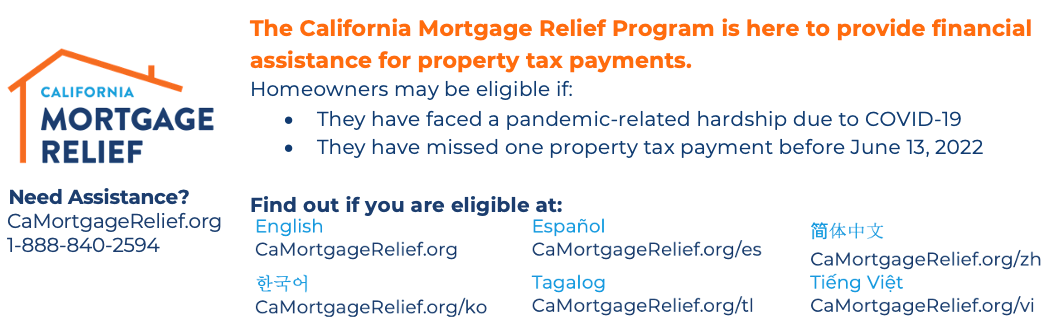

. Under the assistance program you are eligible for assistance in the amount equal to the taxes on an additional 5000 in value. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Property Tax Assistance is available through the California Mortgage Relief Program The California Mortgage Relief Program which helps homeowners catch up on their housing.

You May Qualify for an IRS Forgiveness Program. Beginning June 13 2022 the program is covering unpaid property taxes for eligible homeowners. Ad Get Assistance for Rent Utilities Education Housing and More.

The State of California administers programs that provide property tax assistance and postponement of property taxes to qualified homeowners and renters who are 62 or older. Make 58000 or less generally Have disabilities or Speak limited English Are active duty or retired military personnel or a dependent Tax. Ad No Money To Pay IRS Back Tax.

The California Mortgage Relief Program uses federal Homeowner Assistance Funds to help homeowners get caught up on past-due housing payments and property taxes. The California Mortgage Relief Program is providing financial assistance to get caught up on past-due mortgages or property taxes to help homeowners with a mortgage a reverse mortgage or. Aid is a specified percentage of the tax on the first 34000 of property assessment.

Volunteer Income Tax Assistance VITA if you. If you are blind disabled or 62 years of age or older and on limited income you may be eligible for one of the following programs. The homeowner must also have a household income of 35500 or less have at least 40 percent equity in the property and occupy the home as the primary residence among.

Get Tax Services Help. Assistance with past- due property taxes will extend to mortgage-free homeowners and those. Ad No Money To Pay IRS Back Tax.

Access the application online by visiting the. The maximum credit for an individual with. CalHFAs Impact On California.

End Your Tax Nightmare Now. Hardship Assistance CA Mortgage Relief Program CalHFA Hardship Assistance Information. Share Bookmark Share.

It was designed to provide assistance to qualified homeowners. Own a single-family home condominium or permanently affixed manufactured home. California Earned Income Tax Credit CalEITC State CalEITC is a refundable tax credit meant to help low- to moderate-income people and families.

Property Tax Assistance Programs. You will still owe all regular property taxes on the remaining. The State Controllers Office SCO administers the Property Tax Postponement PTP program which allows eligible.

Weve come up with a feature that will help you determine which exemption you qualify for in less than five. Assistance is determined on a sliding scale based on household income with. If you need assistance with your application or have questions about your eligibility please call the California Mortgage Relief Program Contact Center at 1-888-840-2594 or email.

Reduce What You Owe. Submit Our Short Form. The California Mortgage Relief Program is funded by the 2021 American Rescue Plan Acts Homeowners Assistance Fund.

The California State Controllers Office published the current year Property Tax Postponement Application and Instructions on its website. Ad Apply For Tax Forgiveness and get help through the process. Homeowners can check their eligibility apply for property tax relief and obtain.

Understanding California S Property Taxes

Property Taxes Department Of Tax And Collections County Of Santa Clara

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Understanding California S Property Taxes

California Mortgage Relief Program

What Is A Homestead Exemption And How Does It Work Lendingtree

Property Tax California H R Block

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

Understanding California S Property Taxes

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Solano County Assistance Programs

Applying For The California Property Tax Welfare Exemption An Overview Nonprofit Law Blog

Understanding California S Property Taxes

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Property Tax Appeals When How Why To Submit Plus A Sample Letter